Last Sunday the ECB published its quality assurance results, its stress tests of our systemic banks. It was, from where I am standing, a sad day.

Last Sunday the ECB published its quality assurance results, its stress tests of our systemic banks. It was, from where I am standing, a sad day.

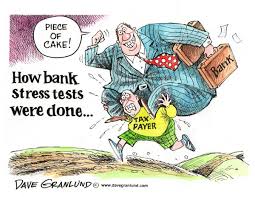

Back in 2010, the European Banking Authority (EBA) disgraced itself with stress tests that passed with flying colours banks that would fail in short shrift in the months to come. What we have now done is to discredit the only proper institution that the Eurozone has: the ECB.

Am I being too harsh? I do not think so. Let us move, for a moment, to the other side of the Atlantic. What is it that gives the Fed and the FDIC power over banks? Is it the fact that the Fed-FDIC is the banks’ single supervisor? No. What gives the Fed-FDIC power over banks is the common knowledge that, when it assesses that a bank is insolvent, it has no serious qualms saying so. The reason, of course, is that it not only has powers of supervision (i.e. access to their books) but, crucially, powers of resolution and, if it so judges, the power to force mergers or to recapitalise the failing bank.

Suppose that, instead, the Fed-FDIC had, as the ECB does, only the power to scrutinise the banks’ books. Imagine now that, with one this power, the Fed-FDIC were to discover that some bank in Nevada or Missouri is in trouble. If the Fed-FDIC’s charter precluded it from doing anything else other than to announce the bank’s insolvency, its supervisory power would mean little. For if it were common knowledge that the fiscally stressed State of Nevada or Missouri would have to borrow from money-markets to pay for the depositors’ guaranteed deposits, as well as for any new capital the banks needed to be salvaged, the rest of the state’s banks would face a run, the states would see their borrowing costs skyrocket and, soon, a combined banking and fiscal crisis could be rummaging throughout the ‘dollar zone’. To put this crudely, the good people at the Fed would have no alternative than to keep their mouths shut, to conceal the bad news, to cover up for the bank’s problems and try to find some hush-hush way of bolstering its capitalisation.

This is precisely the sad state to which our, so-called, Banking Union has pushed the ECB’s supervisors into. As long as the ECB is not the sole authority on bank resolution, and as long funds for dealing with insolvent banks are to come (in the final analysis) from the fiscally stressed states, the death embrace between weak states and fragile banks will continue. And so will the credit crunch in the regions of the Eurozone where austerity is already taking its heavy toll on demand, having annihilated any urge to invest in productive activities – as opposed just to bargain basement unproductive assets.