Audio and transcript of the keynote I delivered on 5th May 2014 in Seattle in the context of the CFA Institute’s Annual Conference entitled The Future of Finance.

Audio and transcript of the keynote I delivered on 5th May 2014 in Seattle in the context of the CFA Institute’s Annual Conference entitled The Future of Finance.

You can hear the talk by clicking on the player below.

A transcript follows – which is also downloadable in pdf by clicking here.

1. Introduction

It is an honour and a distinct privilege to be in your midst this afternoon.

My topic today is ‘digital economies and the insights they harbour on the future of markets, money, corporations and democratic politics’.

We seem to be besotted with technological change, which is, of course, understandable. Technological change performs for society the role that mutations play in biology, disrupting adaptation and giving the wheel of history another twirl.

Having said that, it is incumbent upon me to warn you, right at the outset that I am no evangelist for digital economies. If anything, I am a ‘sceptical enthusiast’ – a contradiction in terms, I know, but then again, I am used to being a living, breathing contradiction. After all, ladies and gentlemen, I am a… Greek Economist!

Seriously now, — technological fixes to time-honoured problems are all the rage in our days.

- Bitcoin is meant to fix money

- social media are seen as the tyrants’ worst enemy

- networked robots are to help countries like Japan deal with demographic declines

- the Internet is often portrayed as the solution to our flagging democratic processes

AND YES

- studying videogame or other digital economies is promoted as an alternative to tired old economic analyses of mainstream markets.

These claims are fascinating. Alas, they are also dubious. My task today is to try to highlight important insights, while exposing the many phoney promises.

I shall begin with several basic lessons from the study of the social economies that emerge spontaneously within multiplayer videogames; lessons you may benefit from. Then I shall move to digital money, Bitcoin in particular – to democratic politics in the era of the Internet – before, finally, addressing the future of corporations and, indeed, capitalism itself.

2. Markets

As they say, at the beginning there was arbitrage.

The dream of arbitrage, of buying low and selling high, is the driver of all commerce but also its own worst enemy: for as everyone is trying to pursue it, the potential for arbitrage disappears. And when it does disappear totally, we have equilibrium – the holy grail of us, economists.

The quicker equilibrium is achieved, the greater the market’s efficiency and the worse the prospects of profiting from arbitrage. This is why the speed with which markets approach equilibrium matters to everyone.

Digitisation ought to procure instant equilibration. Speed and the transparency that the Internet offers should, in theory, eliminate it. But, as High Frequency Trading shows, allowing Michael Lewis to make a tidy profit from his most recent book, technology throws its own spanner in the works of competition, by creating new forms of rent seeking behaviour based on minutely differential ultra-high speeds.

A couple of years ago I had the opportunity to study the sophisticated barter economy of a particular video game, Team Fortress 2, while I worked with the good people at Valve Corporation, at nearby Bellevue. Players of TF2 trade energetically many digital items in a secondary markets for these items; items that come to their initial possession either through skill or through purchasing them, for real dollars, from Valve’s primary market – the Steam online trading platform.

The reason why I am bothering you with these videogamers’ communities is that they are an excellent source of insights regarding the effect of perfect information on arbitrage opportunities. Unlike equity and bond markets, where High Frequency algorithms are wrecking havoc, in videogamers’ communities real people do all the trading. But they do so in the Panopticon environment of the Internet, in which everyone sees, at the same time, all the bids and asks, all the trades, every activity there is.

On a personal aside, let me confess to you that the idea of studying such Big Data is an economist’s wet dream. In our standard work, we economists have to use econometrics if we want to make sense of economic data. Please don’t tell anyone I said what I am about to say: Econometrics is a travesty!

The problem with econometrics is twofold: First, the ‘reduced form’ we test can be shown to be consistent with an infinity of competing theories, therefore guaranteeing that we will have no way of discriminating between these theories. Secondly, you only need to have seen how econometric data is put together to decide that you most definitively do not want to use it. A little like never touching a sausage if you have witnessed their manufacture.

In sharp contrast to our incapacity to perform truly scientific tests in ‘normal’ economic settings, video gamers’ economies are a marvelous test-bed for meaningful experimentation. Not only do we have a full-information set, making sampling superfluous, but, more importantly, we can change the economy’s underlying values, rules and settings, and then sit back to observe how the community responds, how relative prices change, the new behavioural patterns that evolve. We can, in short, play the role of an omniscient and also an omnipotent god. An economist’s paradise indeed…

But let’s go back to the question on arbitrage: Does the perfect and symmetrical information afforded by the Internet to video gamers kill off all opportunities for arbitrage instantly? Or do arbitrage opportunities linger long enough for players to have a decent chance at profiting from buying low and selling high?

The answer is: Arbitrage opportunities seem to survive perfect information. Transparency does not kill off the prospect of trading one’s way into a worthy bundle of profit.

Before demonstrating this result to you, based on a study involving TF2’ huge trading data set, and covering in real time millions of trades over years on end, let me state that I had expected to find evidence not only of equilibration but also of a transition from barter to a moneyed economy.

Economic history tells us that, as barter economies grow in sophistication, they become ‘monetised’. That is, some commodity evolves quite quickly into the role of the numeraire, the money-unit, the currency; as, for example, cigarettes did in concentration camps and still do in prisons. Or salt once did. Or gold, for that matter. This is why we have never witnessed truly sophisticated barter economies: by the time they become sophisticated, they have ceased to be based on barter – for reasons similar to why we have not developed hugely sophisticated training wheels for professional cyclists.

Is this what we found? No, not at all. My close study of the TF2 economy revealed a more complex picture; one in which barter still prevails even though the volume of trading is skyrocketing and the sophistication of the participants’ economic behaviour is progressing in leaps and bounds. We found that some items begin to evolve as currencies but then, all of a sudden, another competing item takes over. Moreover, we discovered that there are ‘islands’ within the community within which some item has become the island’s currency but has failed to acquire a universal monetary role.

This is interesting because it indicates that, say in the international arena, there is no natural tendency for some currency to dominate; to become the reserve currency that enjoys an exorbitant privilege, as the US dollar has been enjoying for decades now. Which perhaps means that if some currency (or item on our video game economies) does dominate, the reason has to be found in some ‘artificial’ or political virtue. “Like what?”, I hear you ask. Like geopolitical dominance, for instance, is one possible reply.

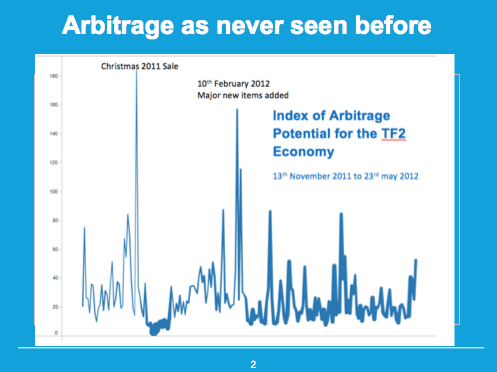

Returning to my study of arbitrage in the TF2 economy. The non-emergence of a definitive numeraire, of a currency item, was frustrating, in addition to being interesting. The reason it was frustrating was that it made the task of observing arbitrage opportunities harder. For when all items are prices in dollars or ‘hats’ or whatever, it is easy to spot arbitrage opportunities. But when there is a plethora of relative prices, it is not so easy. Still, this gave me the joyful task of working out a computational method for creating a fictitious currency, out of all the observed bilateral relative prices, and use it to work out the arbitrage opportunities that prevailed in real time. The following diagram depicts this index of arbitrage opportunities for the months between November 2011 and March 2012.

The peaks represent moments when there was a great deal of room for arbitrage while the line’s thickness reflects the volume of actual trades. It is no great surprise that these peaks coincided with a Christmas sale or the launch of new items which the community required some time to price properly. And here is the crux: If this community of switched-on, keen, perfectly well informed traders can still leave room for considerable, and variable, arbitrage, the efficient markets’ hypothesis, (according to which there is no room for systematic profits from buying and selling) is plainly false. This we have always known intuitively. It is ever so nice, however, to see it in full Technicolor!

The peaks represent moments when there was a great deal of room for arbitrage while the line’s thickness reflects the volume of actual trades. It is no great surprise that these peaks coincided with a Christmas sale or the launch of new items which the community required some time to price properly. And here is the crux: If this community of switched-on, keen, perfectly well informed traders can still leave room for considerable, and variable, arbitrage, the efficient markets’ hypothesis, (according to which there is no room for systematic profits from buying and selling) is plainly false. This we have always known intuitively. It is ever so nice, however, to see it in full Technicolor!

Inequality

Before I move on to the future of money in the Internet era, which is my next topic, I thought you might be interested to look at some data on the grand topic of the day: Inequality. Just as prior to 2008 the Fed was fooled by low price inflation, when the problem was paper wealth or asset price inflation, so too today we are facing the problem of knowing our societies are undermined by inordinate levels of wealth inequality when we can only observe income inequality. Wealth is very hard to compute. If anything it is as radically unobservable as it is the source of real social power.

Indeed, very few countries have passable data on the wealth distribution among their citizens. Sweden is one, the UK used to be another. Interestingly, however, it is straightforward to compute the wealth distribution within a community of videogame players. How? Given our omniscience, we know the stock of items they own at every point in time and, given our observation of exchange rates between them, we can compute the exchange value of each item, use these values to price the stock of wealth of each player who has been active for, say more than six months, and hey presto we have our wealth distribution.

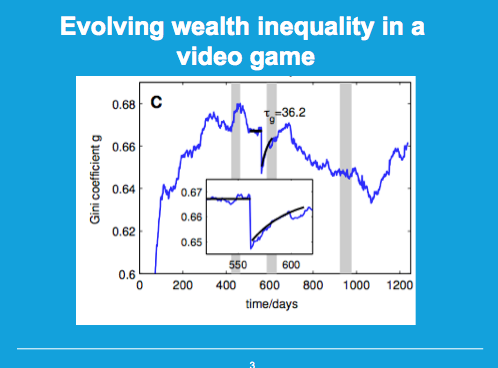

One thing we can do is to trace the evolution of wealth inequality through time. The next diagram pertains to a study on wealth inequality in a particular videogame community, called Pardus, involving some 400 thousand players as it unfolded over a period of 1200 days.[1] The sharp reduction that you see, and which is blown up in the inset, concerns an experiment in which players were invited to give Christmas presents to each other. The sharp fall in wealth inequality is due to their response to this call, exactly during the Festive Season. Notice the quick return of inequality, even if not to the original level, once the festive sprit of gift giving subsided.

Diagram courtesy of Fuchs and Stefan Thurner (2014).

Diagram courtesy of Fuchs and Stefan Thurner (2014).

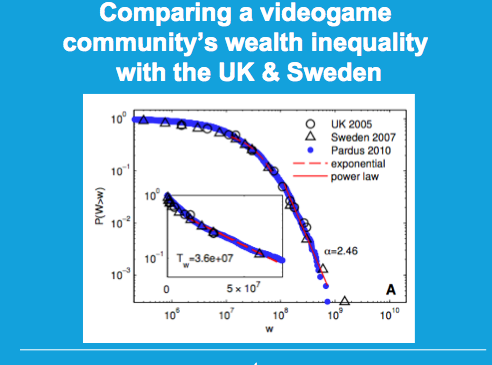

It is also of interest to juxtapose this video game community’s wealth inequality data against data derived from Sweden and the UK, which as I said, report their wealth distribution data: Yes, the three Lorenz curves almost coincide, raising fears that perhaps our real life societies are not much different, horror of horrors to our video game communities. The only substantial difference lies in the fact that, thankfully, a social safety net does not allow the analogue societies’ Lorenz curves to hit the horizontal axes – something that does matter a great deal when people die of starvation but not so much when video gamers have very few digital items that they crave.

On a speculative note, my interpretation of this evidence is that our societies, even when adorned with strong welfare systems, are still riddled with market failures and free rider tendencies not too dissimilar to those in video game communities. This does not mean that our societies cannot evolve out of that inauspicious equilibrium. But that is a bigger story to which I plan to return later.

To conclude, there is a wealth of information and insights that we can glean from watching people play multi-player video games. However, at this point I must warn you that these observations and insights are utterly devoid of macroeconomic content. Micro content yes. Macro content none!

Diagram courtesy of Fuchs and Stefan Thurner (2014).

Diagram courtesy of Fuchs and Stefan Thurner (2014).

Why macro-economically irrelevant?

Robert Radford was a British prisoner of war, a pilot captured over Germany and thrown in a POW camp. When he got out, he published in 1945 a splendid paper in Economica,[2] a well respected academic economics journal. In this article, which I highly recommend, he recounts how a fully-fledged pure exchange market economy emerged spontaneously in his POW camp. What happened was this: The Red Cross would periodically contribute a box of goodies per prisoner, containing some chocolate, coffee, tea, marmalade, cigarettes etc. Once these ‘endowments’ were distributed, prisoners would start trading amongst themselves as if in order to attain Pareto efficiency. So, for example, French POWs would offer their tea endowments to the Brits in exchange for coffee. And so on. Trading boards, spot prices, a futures market, even an insurance market emerged in the camp. Cigarettes, naturally, soon became the currency unit and average prices began to reflect the quantity of cigarettes in the camp – for instance, a heavy nearby bombardment by the RAF of the United States airforce would cause deflation, as the angst ridden prisoners would smoke many cigarettes, thus reducing the quantity of money and causing a deflationary blip which, nevertheless, might last for a while.

Re-reading Radford’s paper, after having experienced video game social economies, made me realise how similar they were. And they made me also think that both, video game and POW economies, differed substantially from a capitalist economy. What was the difference? The lack of a labour market and the lack of a money market. The two markets that give really-existing capitalism its character and which make macroeconomics so different to microeconomics.

In the POW camp, the traded products were produced exogenously and thrown into the camp like manna from heaven by the Red Cross. Similarly in video game economies: they are produced by the video game company and are either thrown in like manna from heaven (in the form of so called item drops) or are purchased with dollars and brought into the game. Labour does exist. In the POW camp Radford explained that some impecunious prisoners would offer barber or valet services in exchange for goods traded. In video game communities, designers have the opportunity to create their own designs and sell them through the company’s e’shop, just like Apple and Google encourage developers to monetise their designs by selling them at the iTunes or Google Play digital stores. So, there is production and there is labour. Nevertheless, there is no labour market. There is no market within these economies where one player, or prisoner, would offer labour services to a second party (in exchange of a wage) for the production of a commodity to be sold to a third party, with the second party being the residual claimant.

Similarly, there is no money market. In the POW camp there was a fledgling market for lending cigarettes but it proved highly unstable and crashed, due to high default rates and an institutional inability to exact interest. Similarly, in the video game economies I have looked at nothing resembling a financial services or money market has ever emerged.

These ‘absences’ render digital or virtual economies macro-economically meaningless. This is important because it places limits on the transferability of insights from these digital worlds to our own.

With this cautionary note, I am now going to proceed to the next topic: The Future of Money.

3. The Future of Money

Money not only makes the world go round but it is also one of the two reasons that purely digital economies, like those that arose within videogame communities, are, so far, macro-economically irrelevant.

Nevertheless, one must have been living in a cave not to have heard of the latest fully digital innovation that has been on everyone’s lips in recent months: Bitcoin and other such digital cryptocurrencies. If the hype is to be believed, Bitcoin is the future of money, a mathematical solution to the problem of currency manipulation by unscrupulous politicians and unaccountable bureaucrats that the Internet has made possible.

So, what can we learn from Bitcoin, but also from in-game currencies about the present and future of money?

Let us begin with in-game currencies, like the Linden dollars in Second Life or the Interstellar Kredits in Eve Online. They are, analytically, similar to the POW camp’s cigarettes: exogenously supplied, by the game company, with a quantity that is fixed at any given moment in time and proportional to the average prices in the economy. The only difference is that, unlike in the POW camp where the money, or cigarette, supply was not only exogenous but also fixed, in-game currencies are exogenous but can vary dramatically as players keen to buy goods can convert real dollars or euros to these in-game currencies therefore boosting the in-game money supply at will. Game companies, essentially, play the role of central banks, increasing or decreasing the exchange rate between in and out-of-game money in a bid either to deflate bubbles or to re-inflate the economy after a bust.

All this is anathema to the Bitcoin enthusiasts. For them the task is to cut out the ‘middleman’, to institute a currency that is immune to manipulation by anyone, let alone a grey, unelected central banker. For them, the issue is not whether money will be digital or not but whether it will be as decentralised as the Internet or as centralised as Microsoft. Or Mastercard. Or the Soviet Union. Or the Federal Reserve System.

Before we delve deeper into the debates on Bitcoin and the Future of Money, allow me to state, for the record, my own take on Bitcoin:

- Bitcoin is, above all else, a beautiful algorithm.

- A brilliant answer in search of a worthy question.

- A breath-taking solution to as yet undiscovered problems!

So, contrary to its evangelists’ grand proclamations, democratising and de-politicising money will not be one of Bitcoin’s contibutions to humanity, I am afraid. Indeed, it should not replace government issued money. Put simply, no de-politicised currency is capable of ‘powering’ an advanced, industrial society.

What makes the Bitcoin algorithm ‘beautiful’ is that it makes possible a decentralised network within which trust is built because everyone is monitoring everyone else. There is no sentry. No guardian. No Leviathan who may become tyrannical or fall asleep on the job (as regulators did prior to 2008). Instead there is a type of benign Benthamite Panopticon where everyone is kept honest because everyone else is watching every activity, every exchange, every transaction. It is truly splendid, in that regard.

BUT it is not a sound foundation for an alternative monetary system.

- Why not? To begin with, it is tiny in size.

- Its total global value in real money is less than the bailout money ‘given’ by European taxpayers to a smallish Greek bank last year.

- So far, it is a digital tulip or, to paraphrase Keynes, it is a bubble on a whirlpool of speculation, rather than a bubble on a growing stream of enterprise.

- Of course, BITCOIN enthusiasts will argue that what matters is its growth potential.

- I am not convinced.

Bitcoin suffers from two separate problems: The Security Problem and the Economic Problem

- The Security Problem is that a hacker can hack into your computer and disappear with your BITCOINs. And if you entrust your BITCOINs to an unregulated BITCOIN bank, it is the banker that may run away with your BITCOINs or be hacked himself – the equivalent of a bank robbery. The Mt Gox experience.

- The Economic Problem is entirely separate. Whereas the Security Problem may wreck BITCOIN, if BITCOIN is not wrecked and grows into being macro-economically significant, it is BITCOIN that will wreck the economy. Why? Because it is designed to mimic the Gold Standard – the monetary system that caused one depression after the other, from the 19th Century until 1929, and which was replaced because capitalism cannot breathe under an exogenous quantity of money.

To see this, recall that Bitcoin’s value comes from its in-built scarcity and its exogenous quantity that grows on the basis of negative exponential function, that will see to it that the rate of growth diminishes until in a few years it hits zero.

So, if it catches on as a proper currency, rather than as a store of value, then, by definition, the rate of increase in the quantity of goods and services purchased will outpace the rate of increase in the supply of Bitcoins. Thus, the available quantity of Bitcoins per each unit of output will be falling causing deflation. And why is this a problem? Because even if all prices fall at once, people’s debt will not and a chain reaction of insolvencies will hit us, causing the worst fate of any market economy: Debt Deflation. Think Great Depression here in the United States, or Greece today

As long as our economies feature large debts, a macro-economically significant Bitcoin would be detrimental to stability, prosperity and economic growth. Video-game economies and Internet-based digital money, that are free from governments and states, are exceptionally interesting but, as long as they lack debt markets, they will remain peripheral to really existing capitalism.

One may retort that perhaps it would be a godsend to re-configure market economies so that they are debt-free. But let me remind you that debt is to capitalism that which Hell is to Christianity: seriously unpleasant but absolutely necessary.

Capitalism unleashed incredible productive powers by reversing the three stages of economic activity. Under feudalism, the three stages came in the sequence of production, distribution, financialisation. Peasants produced agricultural commodities – that’s production, then the Sheriff would come in to claim the Lord’s share – that’s distribution; finally, the Lord would sell his surplus food in local markets for money part of which would be lent out – that was financialisation.

This sequence was turned on its head by capitalism: First came debt, or financialisation, as the entrepreneur borrowed money to hire the means of production from landlords, labourers and suppliers. Second came distribution, as the entrepreneur would hand over these borrowed funds to the landlord, as rent, to the workers, as wages, and to the suppliers, as returns to their capital. Production would now be the final stage, with the resulting commodities being sold in markets and the entrepreneur, if he was lucky, keeping the residual, or profit.

The reason why capitalism multiplied productivity by a huge factor, thus creating incredible wealth (but, paradoxically, also unprecedented poverty) is because of this reversal of the sequence, placing finance, or debt, at the top of the queue. It was as if the entrepreneur put her hand through the timeline, grabbing some value that was not yet produced from the future, bringing it to the present, putting it to good use in the production process so that goods could emerge that would then be sold so as to return to the future the value taken away from it – with interest!

Debt, ladies and gentlemen, is of the essence for really existing capitalism. While too much debt, like too much of anything, can be a terrible thing, it is the case that No debt, No capitalism! This is why the fantasy of a future with stateless money, like Bitcoin or some variant of it, is dangerous: its in-built deflationary tendency makes debt unsustainable. And it is also why our videogame communities, despite the highly sophisticated economies that they have generated, remain macro-economically irrelevant, as they lack debt markets and, indeed, labour markets

One last wrinkle is perhaps worthwhile at this stage: we have a tendency to misunderstand money’s role in society. To think of it like the cigarettes that Radford analysed in the context of his POW camp – as some commodity whose durability and divisibility allowed to turn into money.

Archaeological evidence of accounting books, dating to 3500BC and unearthed in Mesopotamia reveals that the ancient accountants had painstakingly carved a log of who owed what to whom, of how much grain each resident within some temple jurisdiction had stored at the communal warehouse, of how much barley was owed to those working in the temple. What is beguiling is that the unit of account often took the form of silver coins that, in fact, did not even circulate (or had not even been minted). Indeed, everyday use of coins as a means of exchange was not witnessed for several thousands of years after it they were used to record debt obligations.

So, once again, we see that debt is at the heart of monetised and macro-economies. Unless digital economies develop debt markets and digital crypto-currencies overcome their deflationary tendencies, which make debt unsustainable, the future of money will continue to feature Central Banks – even if it is circulates entirely via digital wallets.

Having said that, it would be precisely wrong to claim that the beautiful Bitcoin algorithm is irrelevant from the perspective of monetary policy. As one who has been engaging in the Eurozone debates, it occurred to me recently that Bitcoin-like technologies could be utilised profitably to liberate Europe’s member-states from the straitjacket of the Gold Standard-like design of the euro. Bitcoin, while deflationary and Gold Standard-like itself, can inspire a strategy for ending the monetary asphyxiation of many proud European nations.

To this effect, I have recommended that member-states organize their own crypto-currencies based on future tax credits expressed in euros. FTCoins, or Future Tax coins, as I called them, could provide:

- a source of liquidity for the governments that is outside the bond markets, which does not involve the banks and which lies outside any of the restrictions imposed by Europe’s Central Bank

- a national supply of euros that is perfectly legal in the context of the European Union’s Treaties, and which can be used to increase benefits to society’s weakest members or, indeed, as seed funding for some desperately needed public projects

- a mechanism that allows taxpayers to reduce their inter-temporal tax bill

- a free and fully transparent payment system outside the banking system, that is monitored jointly by every citizen (and non-citizen) who participates in it courtesy of a Bitcoin-like blockcain or public ledger that allows everyone to keep tabs on the quantity of these FT Coins that the government issues.

In summary, while Bitcoin is not the future of money, and in-game currencies are easier to manage than the euro or the dollar because these economies are macro-economic simpletons, Bitcoin’s technology offers us opportunities for creating new instruments that are supportive of existing monetary policy. Indeed of democratising state money without replacing it.

We still have not worked out the best way of utilising these algorithms. It is the reason I called Bitcoin a beautiful algorithm that offers brilliant solutions to problems we have not yet articulated.

4. Politics and the Future of Democracy

Speaking of ‘democratising money’ brings to mind the ubiquitous claims that the Internet is democratising politics. That it can encourage citizens to become involved, to overcome their apathy and, therefore, to re-invigorate our democracies. Might digital, Internet-based technologies hold the key to improvements in the quality of our democracies?

The answer must, yet again, be nuanced.

It is helpful to begin by distinguishing between e’government and e’democracy, just like I distinguished earlier between Bitcoin and other digital currencies. E’government is about using existing institutions more effectively, with greater efficiency and transparency. But e’democracy must mean something quite different, if it is to have substance.

What though? I suggest that a mental rip to ancient Athens, where the concept emerged, may help. This is what you get when you invite a Greek to address you. It’s, I suppose, in my nature, as the scorpion, allegedly, said to the frog.

Athenian democracy can be dismissed because of its unappetising reliance on slavery and its exclusion of women. Be that as it may, the Athenians invented neither slavery nor sexism. What they did invent was the notion of a citizen who enjoys not only free speech but also isigoria – a word that means equal say in the final formulation of policy, independently of whether he was rich, comfortably off, or indeed a pauper eking a modest existence out of manual labour.

Aristotle’s definition of democracy is telling in this regard: A constitution in which “the free-born and the poor control the government; being at the same time a majority”

Democrats invoked the Demos in a bid to assert the rights of the poor to isigoria. Not merely to have a voice but, more importantly, to have a voice of equal weight.That democracy survived even if only for a few decades in classical Athens is an historical miracle. Never before (and possibly never since) had so large a percentage of poor labourers enjoyed such unprecedented direct decision making powers in matters of State.

One may, reasonably, argue that direct, Athens-like, democracy is not possible in populous societies which make representative democracy inescapable. However, there is a presumption here: The presumption that, while we would like something like Athenian direct democracy, it is infeasible.

Suppose however that, using the Internet, it suddenly became practicable to have direct e’democracy. The question then would be: Do we want the Demos to rule? Really?

My answer would be, yes, I would. Only I fear I would be in a tiny minority.

I believe that a fair reading of modern liberal democracy’s history confirms that the devaluation of citizenship was intentional and that it was considered, at least by the powers-that-be an integral component of a ‘successful’ modern democracy; not a failure to be corrected by technical means (including the best technology has to offer).

The liberal democracies that e’democracy is meant to rescue from apathy have their roots not in ancient Athens but in constitutions of a Protestant pedigree. A constitution is good, in this vein, if it exploits efficiently the ‘fallen nature of man’ – his selfishness and his propensity to put self-interest before the Common Will – in order to promote the broader social objectives of liberty, stability and prosperity.

You can almost smell the polished pews, hear the thundering voice of the preacher. And if you were ever a student of political economy, the image will come to you of Adam Smith’s invisible hand, working supra-intentionally behind the self-interested merchants’ backs, pushing prices down, quantities through the roof, and thus procuring the Common Good against the mean merchants’ private Will.

Making our way from Smith’s Scotland to the United States, it is arguable that the Founding Fathers invented the idea of the American People, and of their ‘sovereignty’, as a means of instituting a stable government over which the People would have no direct control. Though representatives were to be elected, the Federalists were particularly wary of a ruling Demos. The multitude was to stay out of political deliberation and be contented that they are represented in Congress by their social superiors. Who were these to be? Unlike Plato who thought that the ideal Republic ought to be run by the philosophers, the Federalists had another category in mind: The merchants. Today, it would be the corporations.

Seen from this perspective, is it not the case that voter-apathy and oligarchy were designed into our liberal democracies at their inception? I think that this question is pertinent when we discuss the impact of the Internet on democratic institutions for a simple reason: If democracy is floundering by accident, and due to the transactions costs involved in participating, then the Internet could solve the problem, at least potentially. But if, in sharp contrast, apathy is built into our democracies then perhaps a technical fix will not do.

My view on the matter is that, over the decades, the economic sphere – that is, the human interaction that produces things and services of value and distributes that value around – became increasingly autonomous from politics. Put differently, political goods lost value and authority over the economic sphere, or more precisely, the financial realm. A crisis of democracy followed quite naturally.

In large, complex societies where citizenship rights are widespread, representative democracy, increasingly inter-mediated by Internet-based means, is inevitable. But for people-rule to make a comeback, for the Demos to be empowered, we need much, much more than technology. To materialise, e’democracy must help breach the two-century old divide between political and economic power. Alas, this would mean the re-distribution of direct political control of the production and distribution process.

Is something like this possible? Yes. And no. No, because as long as corporate power remains high and largely disconnected from the sphere of democratic politics, no Twitter or Facebook campaign will do it. And yes because Internet technologies are quietly eating away at the foundations of corporate power, making e’democracry less and less of an impossible dream.

5. Technology and the Future of Corporations

Despite the celebration of markets, that is typical of our market societies, corporations themselves can be thought of as market-free zones. Within their realm they allocate scarce resources between different productive activities and processes hierarchically – with no recourse to markets or prices. Microsoft, JP Morgan, GM, , in this view, operate outside the market; as islands within the market archipelago. They are the last remaining vestiges of pre-capitalist organisation within… capitalism.

This, however, may be beginning to change. And this momentous change became visible to me while studying the way in which employees of videogame companies were relating with their customer base as well as with one another.

Multiplayer video games are breaking one important barrier that makes a corporation sustainable in market societies: the barrier between producer and consumer. What is the product that a video game company produces and ‘supplies’ to its customers? The game universe itself. However, the players themselves are part of that universe and, through their inventive play and economic behaviour, they help ‘produce’ the social environment that they consume in ways that the company had never imagined. Soon after, they begin to produce digital goods that they sell through the company’s app store in such numbers and such quality that the company’s own developers find it impossible to compete with.

This ‘blurring’ of the consumer-producer borderline is not enough to bring down corporations. If anything, at least in the early stages, it strengthens corporate power as the company claims part of the value that customers have produced as its own. However, as time goes by, something else happens: players acquire the tools to build their own digital universes and, at the same time, salaried developers, working for traditional corporations, get the idea that they could split from the corporation and work for themselves in conjunction with the community of players who are, by now, bona fide producers in their own right.

In short, the combination of: (A) the increasing input of customers in the production of the digital universe that is the main product, (B) the near-zero marginal costs, and (C) the gradual removal of the borderline dividing developer and consumer, combine to annul the raison d’ etre of the traditional corporate structure.

You may, understandably, put it to me that, while this may all be true regarding video games, it is not pertinent in all the other industries producing analogue, material products. True. But throw a sophisticated 3-D printer in the mix and, suddenly, the picture changes. Like Kodak and photolabs disappeared from our lives, so may the oligarchic corporations. Indeed, there is, in theory at least, no reason why designing a car cannot be like designing a video game – even with drivers participating in the design of their own car, as video gamers are increasingly becoming producers, designers, traders within the markets were they, formally, appear as customers. And while, admittedly, the marginal costs of ‘printing’ a car will never disappear, they will certainly fall and, more importantly, they will be collected by the firm owning the 3D-printer; a firm that will probably resemble a public utility that prints a myriad of different products.

In this world, what will the role of Ford or Toyota be? Assuming that the problems of crash testing, seeking approval etc. can be resolved communally, future corporations will lack their oligarchic hierarchical power structures courtesy of the loss of the economies of scale that now keep them in business as behemoths.

Maybe I am running ahead of the times. But it is not inconceivable that multi-player video games, 3D printers and flat management structures may hold the key to a mass social transformation which will allow for the wholesale reintegration of the economic sphere into political society.

Perhaps then, once corporate power is depleted and replaced by decentralised command over value and production, the Internet will be in a position to empower the Demos so that actual Demo-cracy may become feasible.

6. Epilogue

And thus we have come to the end of this exploration.

I hope my promises at the beginning were not greater compared to what I delivered.

I promised to appear sceptically enthusiastic about digital economies and their lessons for us. To give you examples of insights that we can glean from fully digital markets on arbitrage, trading patterns, wealth inequality, money, the future of corporate power, and the prospects of a more fulfilling democratic politics.

As promised, I also flagged the severe limits of these insights, highlighting the absence from digital universes of the two markets that infect capitalism with the vicious power to bring on recession, even depressions: labour and debt markets.

Those of you who came to this talk anticipating an evangelical rave capable of transporting you to a radically ‘different place’, may feel disappointed. To you I offer solace in the words of T.S. Eliot who encourages to keep exploring, promising that:

And the end of all our exploring

Will be to arrive where we started

…And know the place for the first time.

NOTES

[1] See Benedikt Fuchs and Stefan Thurner (2014). “Behavioral and Network Origins of Wealth Inequality: Insights from a Virtual World”. Mimeo.

[2] R.A. Radford (1945). ‘The economic organisation of a P.O.W. camp’, Economica, 12, 189-201 Click here for a pdf