One of the most poignant analyses of the deeper causes of the Euro Crisis, amongst the many presented in INET’s Berlin Conference, was a paper entitled ‘German Mercantilism and the Failure of the Eurozone’, by Heiner Flassbeck. With the author’s kind permission, I reproduce it here for your benefit. Enjoy. (You can watch Heiner’s presentation here.)

Europe is on the brink of a potentially lethal crisis. A dozen years after the start of the European Monetary Union (EMU) the system is in troubled water and the political leaders, blinded by an anti-government ideology are steering the boat towards some dangerous rocks and risk the end of a long and peaceful ride in a formerly war torn region.

Much has been said about the folly of pushing countries to cut public expenditure, increase taxes and put pressure on wages in the middle of one of the deepest recessions in modern history. However, even the outspoken critics of this approach rarely go to the core of the matter and discuss the long established economic policy strategy of the country that has come out of that recession like a phoenix from the ashes and is still celebrating its unique role and success. To the contrary, Germany is considered by many as the role model for the rest of the union. That is the biggest mistake and the real reason why Europe is committing economic suicide instead of tackling its problem at the root.

Since the end of Bretton Woods, Germany’s economic policy has been based on two main pillars: competition of nations – the new mercantilism and monetarism. Both are irreconcilable with a monetary union of the European size. Firstly, a monetary union is in essence a union of countries willing to harmonize their rates of inflation and to sacrifice national monetary policies. A country like Germany, fighting for higher market shares in international markets, tries to achieve the opposite. It has to undercut the cost and price level of its main trading partners even if it violates the commonly agreed inflation target. Secondly, a large monetary union formed by already closely integrated countries becomes a rather closed economy and needs domestic policy instruments like monetary policy to stimulate growth time and again. German monetarism asks for the opposite, the absence of any discretionary action of central banks and relies solely on flexibility of prices, in particular wages.

This is particularly tragic as the monetary union was an excellent economic idea and its foreseeable failure will prevent many useful attempts in the future to replace the vagaries of the financial markets in the determination of exchange rates by an orderly adjustment of the value of currencies to the fundamentals. But the best idea is useless if its protagonists and those politicians putting it into practice fail to understand it. Insofar the history of the euro is the history of a misunderstanding. From the very beginning neither the European Commission (EC) nor the European Central Bank (ECB) were up to their task of controlling the core of the system effectively. Eventually, this is the result of the failure of mainstream economic thinking. The crucial institutions were misled in their attempt to form a union with diverging economic concepts instead of designing a new economic policy strategy for all. They began to realize their failure only in the face of the crisis – but now the time is running out for successful changes to save the euro.

The roots of the misunderstanding

The core of a monetary union is an agreement of all member States about a common inflation target. A monetary union is not a union of harmonized public budget targets or of harmonized holiday length. Unfortunately, many of those who were in favor of the monetary union had an unbalanced view concerning the constitutional elements of a currency union and still have. The focus of the European Commission and many member states on government deficits and public debt was driven by the overwhelming neoliberal agenda to minimize government and replace it by the private sector wherever possible. Consequently, they fine-tuned the rules for budgetary discipline time and again but ignored the massive divergence of prices, wages and unit labor costs even in the first years of EMU.

But even today the deluge of comments on the crisis of the European Monetary Union overlooks the crucial inflation divergences and the huge external imbalance inside the monetary union. Greece’s budget problems and those of other southern members of EMU are a problem but they are closely related to external deficits. On the other hand, Germany’s sound budget position is to a large part the result of the huge external stimulus it got in the last decade. Spain is under scrutiny of the markets despite a strong budget position because its external deficit still is unsustainable.

The key for the future of EMU, if there is any, is to be found in external adjustment in all countries and not in lopsided government’s belt tightening around the Mediterranean Sea. It is the external imbalances that will force the dissolution of EMU if strong corrective action is not taken soon. The imbalances ask for adjustment on both sides. If the surplus country refuses to become a deficit country, default of the debtor countries is unavoidable because a long and painful recession that would produce a surplus exclusively by falling imports is politically unfeasible. The logic to be applied is the logic of the transfer problem, the problem Mr. Keynes identified in 1919 concerning the dilemma created by reparations Germany was forced to pay for the war. Obviously, large parts of Europe have not yet understood that lesson and its political implications.

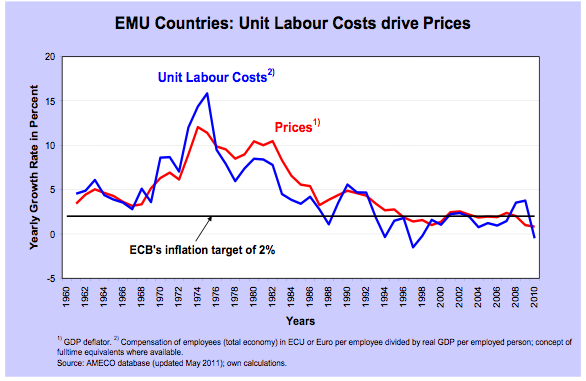

This points to the roots of the misunderstanding. For the European commission as well as for the ECB, as strong believers in monetarism and free markets an approach based on a low but positive inflation rate enforced exclusively by monetary policy was extremely attractive. However, in reality the relationship of money to inflation is weak and even if it would be relevant it would only play at the level of the union as a whole. The most important determinant of inflation at the national and at the European level is unit labor cost growth (chart 1).

The strong correlation of inflation and growth of unit labor cost creates a degree of freedom for monetary policy to stimulate the economy whenever needed. Unfortunately, the monetarist approach of the ECB prevented the use of it. By contrast, the main danger was overlooked. Persistent divergences of inflation rates inside the monetary union are fatal because the differences in the cost and price level accumulate over time and produce real exchange rate appreciation and depreciation and over- and undervaluation for countries without currencies.

The solution for a monetary union to function properly is straightforward: nominal wages at the national level have to rise in line with national productivity in all member countries plus the commonly agreed inflation target. This implies that real wages at the national level grow strictly in line with the growth of national labor productivity. Given the strong mainstream belief in labor market and wage flexibility in Germany and the more lax attitude in Southern Europe a grave conflict was unavoidable.

The German experiment

Since the start of the Union in 1999 Germany, the biggest country and the European stronghold of external stability for several decades had gone new ways to fight high and persistent unemployment. As work time reduction schemes and other measures had failed to bring unemployment down, in a tripartite agreement in 1999 even union leaders agreed to abandon the traditional formula basing wage growth on equal participation of workers in productivity growth and go for a strategy where productivity growth would be available to improve Germany’s competitiveness.

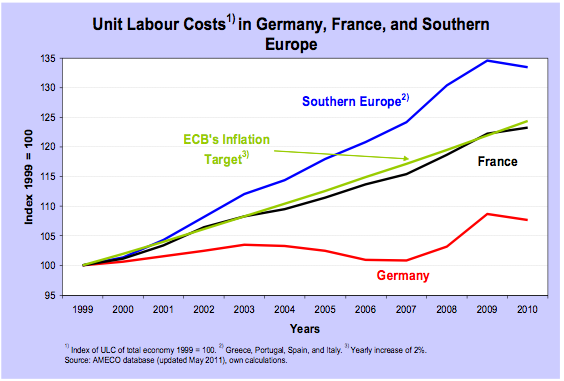

The agreement resulted in a fundamental break with the German tradition of targeting a low and stable inflation rate. This new German labor market approach coincided with the beginning of the currency union and brought about the huge divergence in unit labor costs among the members of the currency union. After the start of the European Monetary Union (EMU) German unit labor costs, the most important determinant of prices and competitiveness did hardly rise any more (chart 2).

On the other side, in most of the countries in Southern Europe nominal wage growth exceeded national productivity growth and the commonly agreed inflation target of two percent by a low but rather stable margin. France was the only country to exactly meet the agreed path for nominal wage growth perfectly; it was all the time in line with the national productivity performance and the inflation target of two percent.

The “small” annual divergence yielded a huge gap over time. At the end of the first decade the cost and price gap between Germany and Southern Europe amounted to some 25 percent, and between Germany and France to fifteen percent. In other words, Germany’s real exchange rate depreciated quite significantly despite the absence of national currencies. The diverging growth of unit labor costs was reflected in similar price divergences. Whereas the union as a whole achieved its inflation target of two percent nearly perfectly, the national differences were remarkable.

The huge gap in unit labor costs and prices had an enormous impact on trade flows. Germany’s exports flourished and its imports slowed down. Southern Europe and France ran into widening trade and current account deficits. While trade at the beginning of the currency union and in many years before was rather balanced, the first decade of EMU marks a period of rising imbalances. Even after the shock of the financial crisis and its devastating effects on global trade that hit German exports, in the years 2010 and 2011 Germany records a global current account surplus of 140 billion Euros per year and some 80 billion against the other EMU countries.

By contrast, the deep recession and the austerity programs in the deficit countries tend to reduce the visible deficits but without a fundamental turnaround in competitiveness the countries lack the stimuli to revive growth. The lesson is simple: Absolute and accumulating advantages of one country against a similar country group are unsustainable. A huge gap in competitiveness has to be closed sooner or later. Failure to do so will create uncertainty on the side of lenders and tend to increase interest rates. As the final repayment of any debt has to be a payment in kind it requires the perspective that a debtor has a chance to generate current account surpluses sooner or later. If the creditors defend their surplus positions by all means default of debtors in unavoidable.

In EMU wages in overvalued countries have to fall relative to those in the undervalued countries, which means a reduction of overall wages with major negative repercussions on domestic demand, growth and the inflation target in the union. If Southern European tries to regain competitiveness unit labor costs undercut the inflation target of the union for a long time and Germany’s ULC do not rise more than hitherto a deflation is the most probable outcome.

The result is disastrous for Southern Europe. With German politics refusing to move in terms of higher wages for a protracted period of time they would need a number of years with absolutely falling wages to come back into the markets. However, the time to do that is not available as falling wages mean falling domestic demand and recession in the first place. In countries like Italy or Spain, with rather small export shares of some 25 percent of GDP, the depression resulting form falling domestic demand would not be politically bearable.

Competition of nations, the new mercantilism

One of the most intriguing discussions covering the last decades has been dealing with the competition of nations or the battle of nations on the field of trade. The age of globalization, more than any other before, has been interpreted as compelling nations to compete in similar ways as companies. The wealth of nations was considered to be dependent on the ability of nations to effectively adjust to the challenges that are created by open markets for goods and for capital. Nations with high standards in their capital endowment would be pressured by trading partners with low labor standards and the other way round. In particular the emergence of a huge pool of idle labor in developing countries like China and India would fundamentally change the capital/labor ratio for the globe as a whole in favor of capital and force the equilibration of low and high wages somewhere in the middle.

Reality seems to have confirmed this view as wages in many high wage countries of the North got under pressure and labor did not succeed to appropriate the same share as capital of productivity growth, as had been the case many decades before. Wage shares are falling and the promise of advocates of market economies that full participation of all people in the progress of society at large would be possible is fading. However, the fact that wage shares are on the decline does not imply that the forces driving this move are those that the neoclassical model of the labor market refers to. Indeed, the political perception of pressure from emerging markets in many countries in the North was based on this model.

A closer look reveals the limits and weaknesses of this approach. The model used is taken by analogy from the competition of companies. However, the model describing competition of companies does not apply to countries, and in particular not to countries with independent currencies. In a dynamic setting, market economy companies compete through the differentiation of productivity. The supply side conditions for all companies are normally given – market forces’ tend to equalize prices of intermediate goods like the price of labor and the price of capital. Consequently, success or failure is determined by the specific value that is added at the company level to the generally traded goods and services. Companies as price takers have to honor the price of labor determined on the market for the different qualities of labor that are offered as well as the price of capital.

Companies able to generate higher productivity through innovation and new products produce at lower unit labor costs than their competitors, which will allow them to offer their goods at lower prices or make higher profits at given prices. The former means to gain market shares, the latter may mean strategic long-term advantages through higher investment ratios. As long as the prices of labor and other intermediary products are given, competitors adjust by implementing the same or a similar technology or by quitting the race through bankruptcy.

At the level of countries this mechanism doesn’t apply because wages are normally set at the level of countries. Be it through mobility of labor at the national level or through wage negotiations in a national context, countries unlike companies are wage setters not wage takers. If wages are centrally negotiated at the level of the nation state or if labor is mobile the so-called law of one price, equal pay for equal work, has to be applied. Consequently, stronger growth of productivity at this level does not increase the competitiveness of all companies against the rest of the world as advantages in productivity are normally reflected in higher nominal wages (and real wages) and unchanged unit labor cost growth.

But even if this mechanism, for whatever reason, would not work at all, a country with rather high productivity but extremely low wages and very low unit labor costs, would not automatically increase its competitiveness or the competitiveness of all its enterprises. The prices in a country using consistently wage-dumping policies to improve its competitiveness would not necessarily be lower than in the rest of the world expressed in international currency. In a world of national currencies and national monetary policy, a country supplying its goods at much lower prices would gain market shares and accumulate huge trade and current account surpluses. Political pressure to adjust wages and prices in international currency would mount and sooner or later the country would be forced to adjust its wages, measured in international currency, through a revaluation of its currency.

Nations can open their borders for trade and capital flows if it is assured that their companies have a fair chance in the global division of labor and that they are not in danger of permanently losing out against the rest of the world. This is the simple proposition underlying all international arrangements about trade in the WTO and elsewhere. If, at the level of the overall economy, the nominal remuneration of the immobile factor in one nation state, labor, exceeds the effectiveness of its use (labor productivity) consistently by a wider margin than in the competing countries, the country is getting into trouble because most of its companies are in trouble. They have to ask for higher prices and accept the permanent loss of market shares or accept lower profits to avoid the loss of market shares.

A situation like this, called an overvaluation due to an appreciation of the “real exchange rate”, is unsustainable and once the accumulated overvaluation reaches some twenty percent or so the crisis is unavoidable. The deficit on the current account is just the most visible indicator of the pathological constellation but not its core. In Europe Italy and Britain were facing such a problem as members of the European Monetary System in 1992; one opted in, one opted out, but both devalued. In systems of adjustable exchange rates, the solution is rather simple: the currency of the country in trouble has to devalue bringing the nominal wages and nominal unit labor costs measured in international currency back to a competitive level. Indeed, devaluation leads to a relative fall in real wages but that is not an important aspect of the analysis.

In a currency union the member countries explicitly or implicitly agree not to go the inflationary way (nominal wages exceeding national productivity by more than an explicit inflation target) anymore or to go altogether. With an inflation target of close to two percent the implicit contract is that nominal wages do not rise more than national productivity growth plus two percent. This means that each country can and should enjoy its productivity increase, be it 1 percent like in Germany or 2 like in Greece, in terms of real wage growth or shorter working hours or both. At the same time each country is encouraged to do whatever needed to improve its productivity performance.

The new mercantilism has been aiming at defending favorable competitive positions created by undervalued exchange rates or by very low wages in relation to productivity. However, this strategy has not been successful. In Germany it destroyed the dynamics of the domestic markets and provoked vulnerability of trading partners that will backfire on Germany. Nevertheless, there is always a risk that governments will use exchange-rate manipulation or wage compression, subsidies and lower corporate taxation to artificially improve the international competitiveness of domestic producers. This kind of “new mercantilism” has to be banned. All countries can simultaneously boost productivity, wages and trade to improve their overall economic welfare, but not all of them can simultaneously Improve their competitiveness and achieve current-account surpluses. Successive rounds of competitive devaluations or races to the bottom are counter-productive and likely to cause considerable damage. Therefore, the world economy needs a new code of conduct going far beyond the existing framework of international rules of trade policy and explicitly include national policies with huge repercussions on international markets.