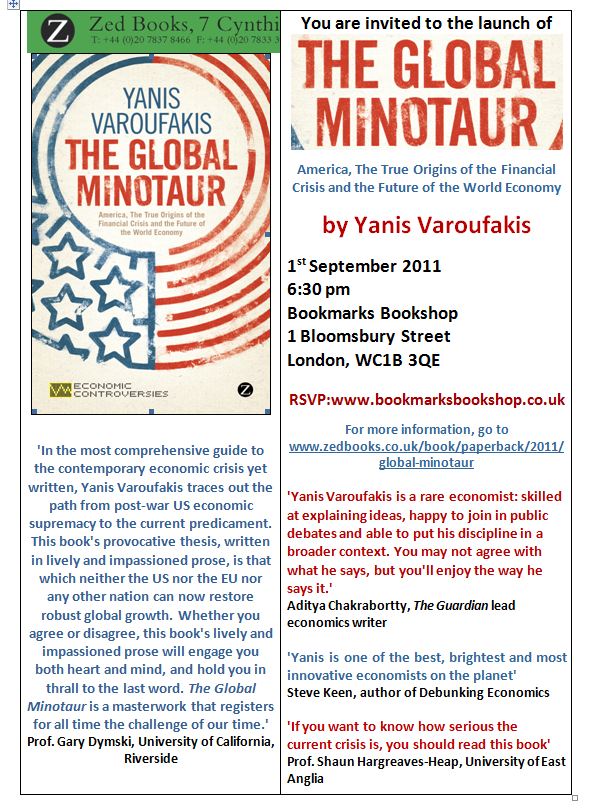

In London on Thursday 1st September at 18.30? Why not join us in the launch of The Global Minotaur at the Bookmarks bookshop , 1 Bloomsbury Street? Aditya Chakrabortty (of The Guardian) will introduce the book. (Click here for a pdf of the invitation)

In London on Thursday 1st September at 18.30? Why not join us in the launch of The Global Minotaur at the Bookmarks bookshop , 1 Bloomsbury Street? Aditya Chakrabortty (of The Guardian) will introduce the book. (Click here for a pdf of the invitation)

Meanwhile, here is a piece that sums up the reasons why this book seems highly relevant to understanding the topsy turvy economic world we live in. I entitle it:

THE MINOTAUR IN THE ROOM.

With the sound of crashing markets and the roar of burgeoning uncertainty reverberating in our ears, it is time to take pause to ask a simple question: Why is the global economy finding it so hard to regain its poise after the Crash of 2008? My contention is that in 2008 the world lost a Global Surplus Recycling Mechanism (GSRM) which was keeping it in the precarious equilibrium that Ben Bernanke mistook for some ‘Great Moderation’ and which caused Gordon Brown to think, calamitously, that the era of boom-and-bust had ended. Grasping how this GSRM worked and why it perished is, I submit, a prerequisite for coming to terms with our current predicament. The key to sustainable growth in a capitalist economy is the successful recycling of surpluses. Every nation, every trading bloc, every continent, indeed the global economy itself, is made up of deficit and surplus regions. California, Greater London and Germany will always be in surplus vis-à-vis Arizona, the North of England and Portugal respectively. Given this chronic chasm, which market forces can never obliterate, the deficit regions are unable to maintain demand for the goods and services of the surplus producers. Thus, without surplus recycling stagnation beckons for surplus and deficit regions alike.

Surplus recycling is commonplace at the national level (e.g. in the United States military procurement often comes with the precondition that new production facilities are built in depressed states). However it is at the global level that the issue of surplus recycling becomes more pressing and difficult to institute. The post-war era was remarkable in that two GSRMs saw to it that the world economy achieved unprecedented growth. The first GSRM lasted from the late 1940s to the early 1970s. The United States exited the war with enormous surpluses which it quickly sought to recycle to the rest of the Western world in a multitude of ways (e.g. the Marshall Plan, wide-ranging support for Japanese industry, endless backing of the European integration project), effectively functioning as a GSRM itself. Alas, this first post-war GSRM broke down, predictably, when America’s surpluses turned into deficits toward the end of the sixties. The loss of that GSRM threw the world into the 1970s crises which did not subside until a new, most peculiar, GSRM was put in place, again courtesy of the United States. This time, America operated like a vacuum cleaner that absorbed the surpluses of the rest of the world, running ever increasing trade and government deficits. Those deficits were, in turn, financed by a tsunami of capital flowing into Wall Street, as the rest of the world recycled its profits by investing them in the United States.

Ancient myth has it that pre-classical Athenians maintained, in the name of peace and prosperity, a steady flow of tributes to the Cretan Minotaur. From 1980 onwards, the ‘rest of the world’ sent a tsunami of capital to Wall Street by which to finance what I call a Global Minotaur (*): a GRSM that functioned as the ‘engine’ pulling the world economy onto higher growth planes and giving the semblance of some ‘Great Moderation’. Alas, built upon the Minotaur-induced mass capital flows into Wall Street, the world witnessed the most intense and profligate financialisation possible. When the pyramids the latter had built caved in, the Minotaur was mortally wounded. With it the US deficits’ capacity to recycle the world’s surpluses disappeared. Since then, the best paid plans of Central Banks’, G20 nations, the IMF etc. have failed to put back together the rude energy of the wounded beast.

To recap, without a functioning GSRM, the Crisis that started in 2008 will continue to migrate across continents and sectors, regularly threatening us with imminent collapse. The trick is to design both within Europe but also globally a new GSRM; one that works just as well as the Minotaur did in its heyday but, at once, one that does not feed on increasing imbalances and destructive inequalities.

(*) The Global Minotaur: America, The True Origins of the Financial Crisis and the Future of the World Economy, London: Zed Books; August 2011