In his pivotal article in yesterday’s Financial Times, Martin Wolf put the matter starkly: “The eurozone, as designed, has failed.” Paul Krugman quickly added this chilling allegory to Wolf’s detailed argument: “If you ask me, the water level has now dropped so far that the fuel rods are exposed. We really are in meltdown territory.” In this post I argue that there is only one path left open to the eurozone for averting meltdown: A full implementation of the Modest Proposal (or something very close to it).

Wolf’s analysis, that led him to his bleak prognosis, is founded on a simple, clear, incontrovertible point (that was made before him by Hans-Werner Sinn): While our politicians are dithering, the European System of Central Banks (ESCB), of which the ECB is one component, is strained to the limit, coerced by the force of circumstance to do that which its charter has explicitly forbidden: To debt-finance the eurozone’s deficit member states (indirectly, of course).

The case is open and shut. In the absence of a common fiscal tool, and in a time of crisis, the monetary authorities are forced to enter the fray of fiscal policy. Moreover, the more underhanded and unspoken the ESCB’s dallying with fiscal policy is the less effective become both its monetary and its (covert) fiscal policy. In particular, Central Banks of insolvent states (e.g. Ireland’s or Greece’s) lend to their nation’s insolvent banks (at about 1%) which, in turn, are replete with bonds issued by the insolvent states (not to mention that they are forced to keep acquiring new short term bonds from them!). And where does the Central Bank of Greece or Ireland find that money? They borrow it from the Central Banks of the solvent, surplus member-states (e.g. Germany’s, Holland’s etc.). Thus, the more the crisis proceeds the greater the mountain of monies owed, effectively, by the insolvent member-states to the Central Banks of the solvent member-states.

This is precisely why intelligent Central Bankers, like Lorenzo Bini Smaghi, scream blue murder every time someone mentions the words “Greek default” (or, euphemistically, “Greek restructuring” or “reprofiling”). Elsewhere I have referred to such fears as derivative of Europe’s Great Banking Conundrum. And what is the essence of this Conundrum? It is that, on the one hand, the banking system cannot survive a major ‘default event’ while, at once, it cannot prevent it.

To sum up Wolf’s, Krugman’s, Sinn’s and Smaghi’s point of intellectual convergence, the strains that the ESCB labours under are gargantuan and escalating every day the crisis continues. Against this background, a default of any kind (not necessarily in Athens) will kickstart a catastrophic sequence of ‘events’ that will render the costs of salvaging the common currency (to the surplus member-states) prohibitive. At that point (as I have outlined here), the solvent member-states will simply bail themselves out, abandon the euro and proceed to set up their own currency or currencies. Unencumbered by the periphery, they will, subsequently, struggle to find ways of dealing with an impending massive recession caused by the loss of export markets (due the revaluation of their new currency/ies). (A note of caution: The fact that Germany managed well in the 1980s under an overvalued DM is not a good omen for the struggle it will have on its hands in today’s globally recessionary environment.) Meanwhile, the very notion of a United Europe will have met the same fate as that of the much lamented Weimar Republic…

Can a Greek default be averted?

Over the next few days and weeks, you will be hearing a great deal regarding the Greek Bail-Out Mk2. Its purpose? To succeed where Mk1 proved such a farcical failure. To turn a Greek default from a near-certainty to a low probability outcome, thus allowing a smidgeon of optimism that the eurozone would return to normalcy; to a situation where the money markets (as opposed to the tax payers) finance the member-states which cannot stand on their own two feet.

Do the European powers-that-be entertain real hope that Bail-Out Mk2 can succeed where Mk1 did not? What will they do differently this time? The answer they give is that, having learnt their lesson the hard way, this time they will take no chances with the Greek government. They will play hard ball in two crucial ways both of which violate the most basic principles of national sovereignty: First, the privatisation program (which is supposed to yield €50 billion by which to retire existing debt) will be carried out by non-Greek officials (who will presumably decided what to sell, the price and the way in which the proceeds will be utilised). Secondly, tax collection will be contracted out to non-Greek collectors.

Setting aside all objections regarding the feasibility and legality of these two draconian measures, let me ask a hard-nosed question: Supposing they do the trick, will these measures avert a Greek default? Not on your Nelly, is the striking answer.

Am I being too pessimistic? Not in the slightest dear reader. During the past few weeks I worked busily to set up a Crisis Monitor Unit on behalf of the Greek TUC (Trades Union Council or GSEE). In association with Dr Tasos Patokos, we have carried out a series of simulations regarding the Greek debt-to-GDP ratio under different scenaria. The findings are startling. Before presenting them here, let me explain that to map out properly the dynamic path of the debt-to-GDP ratio of any country, it is not enough to have data on aggregate debt. One needs a detailed repayments’ schedule, complete with annual bond maturities and official repayment dates/magnitudes. Fortunately, even though this information is not publically available, the necessary data found its way into our simulation.

Of course, every quantitative predictive model is as good as its assumptions. So, to explore this section’s pressing question, we decided to assume that the (grossly unrealistic) targets set by the EU and the Greek government will be met well and truly. Imagine our surprise when we discovered that, even under these official science-fiction-like presumptions, Greece’s debt-to-GDP ratio path remains explosive. Indeed, and this is crucial, the aggressive privatisation drive would make no difference to the probability of default.

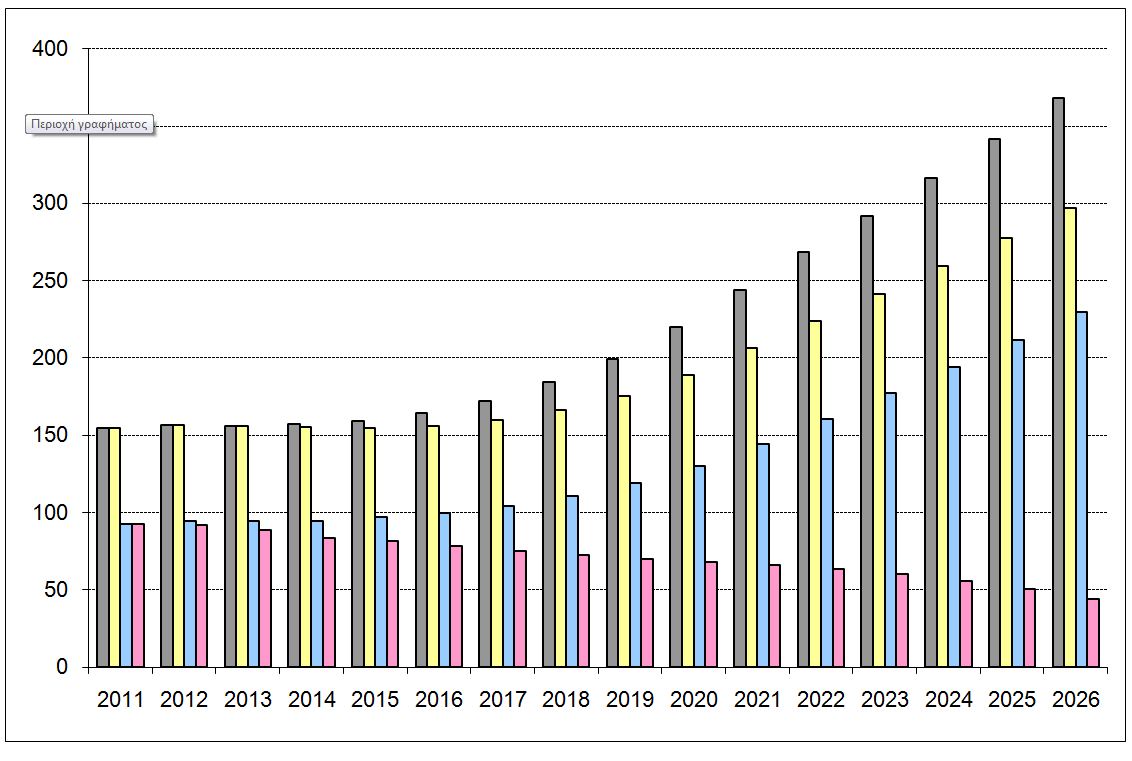

In the preceding diagram, where the vertical axis represents Greece’s debt to GDP ratio, four scenaria are depicted:

In the preceding diagram, where the vertical axis represents Greece’s debt to GDP ratio, four scenaria are depicted:

Scenario 1 (the grey bars): Steady as she goes, with strict adherence to the EU-IMF targets

Scenario 2 (the yellow bars): As in Scenario 1 with the addition of a highly successful privatisation program worth €50 billion in aggregate which yields €15 billion in 2011, another €15 billion in 2012, and a further €10 billion each for 2013 and 2014. All these monies are used to retire debt.

Scenario 3 (the blue bars): The Modest Proposal adopted in part. In particular, we assume that Policies 1&2 are adopted but not Policy 3. In other words, we assume that a part of Greece’s debt is transferred onto the ECB’s books (which issues 20 year eurobonds to cover it) and that Greece repays that debt over the same span of time at no more than 3.3% (which is, in our estimation, above the ECB-bonds’ market rates). Further, we assume that the stressed banks are recapitalised and accept, in exchange for EFSF capital, selective haircuts. Policy 3 (the use of eurobonds to energise the European Investment Bank) is however not adopted, under Scenario 3.

Scenario 4 (the pink bars): The Modest Proposal fully fledged. Policy 3 is also activated with the European Investment Bank carrying out investments within Greece to the tune of 0,9% of Greek GDP (and assuming a very modest multiplier of no more than 2).

The diagram speaks volumes.[1] The first thing to notice is that the privatisation program is irrelevant. The first two time paths (grey and yellow) are just as explosive and lead to default very, very quickly. Given that the difference between them is between no privatisation at all and fully successful privatisation, it is clear that the merits of privatisation (from the perspective of preventing a Greek default) are precisely non-existent: Both time paths lead Greece’s debt-to-GDP ratio to stratospheric levels.

The second poignant result is that the situation is so dire that, even though Policies 1& 2 of the Modest Proposal manage to deflate the debt mountain facing Greece, without the European Investment Bank’s eurobond-fuelled Pan-European Recovery Program the spectre of a future default will return to haunt Europe [even after the unification of the Maastricht-compliant part of Europe’s debt (with the parallel issuing of ECB-eurobonds – see our Policy 2), accompanied by our Policy 1 for dealing with Europe’s Great Banking Conundrum (see Policy 1)].

Indeed, only the fully-fledged Modest Proposal (see Scenario 4) has the capacity to diffuse the problem, and push Greece’s debt-to-GDP ratio into a sustainable path. The picture is clarity personified: The Modest Proposal, including all three of its Policies, is the only thing that stands between reality and a Greek default.

Conclusion

Martin Wolf, Paul Krugman, as well as a number of the brightest Central Bankers on the continent, have argued, correctly, that a Greek default is both inevitable (under the present mix of policies) and catastrophic for the eurozone as a whole. In this post I just demonstrated that they are more right than they know: Presently, they fear that the EU-IMF targets for Greece are over-optimistic. The fact however is that, even if the EU, the IMF and the Greek government manage to convince the gods to answer their collective prayers regarding the Greek budget’s targets and the success of the much adnertised privatisation program, a Greek default is unavoidable.

So, what do we do? Martin Wolf is at a loss. He knows that some form of further continental consolidation is of the essence but, at the same time, he recognises that federation is pie in the sky. This is where the Modest Proposal comes in: For it allows Europe to forge enough common ground to stop the crisis on its tracks without requiring of our fragmented political system to generate a federal push that it is incapable of.

[1] Underlying growth rate assumptions: Assuming that the current austerity and official loan mix is maintained in the future, we input the following growth rates in Scenaria 1,2 and 3: For 2011, we used the official prediction of -3.2%. Thereafter we assumed that the recession bottoms out in 2012, that growth edges up to 1% in 2013 and 2014 before reaching an average of 2% thereafter. For the fourth scenario (in which the EIB is empowered to carry out large scale investment projects, the assumption is that the growth rates rise to 2% in 2012 and stay within a very modest 3% to 3.5% interval thereafter. The Modest Proposal is thus tested under very modest assumptions.